Invest First, Investigate Later

Welcome to issue #19 of Indiscrete Musings

I write about the world of Cloud Computing and Venture Capital and will most likely fall off the path from time to time. You can expect a bi-weekly to monthly update on specific sectors with Cloud Computing or uncuffed thoughts on the somewhat opaque world that is Venture Capital. I’ll be mostly wrong and sometimes right. Views my own.

Please feel free to subscribe, forward, and share. For more random musings, follow @MrRazzi17

The transformative potential of AI is reshaping the entire value chain—from data centers and model providers to infrastructure platforms and horizontal and vertical applications. For venture capitalists like myself, this rare technological inflection point is as exhilarating as it is disorienting. These platform-level shifts are generational, yet their ultimate value consolidation and the criteria for sound long-term investment remain ambiguous amidst the current fervor. The pace and scale of the AI boom have created both unprecedented opportunities and formidable challenges for investors attempting to parse the noise from enduring signals.

History serves as an invaluable guide when grappling with such paradigm shifts. From the advent of automobiles to the disruptions wrought by disk drives and personal computing, technology waves have followed a discernible pattern: an initial frenzy, followed by a "pruning" phase that isolates long-term winners. If historical precedent teaches us anything, it is that the euphoria accompanying emergent technologies often obscures foundational truths. Observing the frenetic pace of investment across the AI stack at valuations that strain plausibility, I frequently confront the unsettling question: Am I the fool?

The Allure of "Invest First, Investigate Later"

This tension calls to mind Stan Druckenmiller’s reflections on the "In Good Company" podcast, where he cited George Soros’s dictum: "Invest First, Investigate Later." He recounted his serendipitous early investment in Nvidia in 2022, predating the "ChatGPT moment" that galvanized the AI zeitgeist:

The engineers were shifting from crypto to AI. That was the first sign. Then my young partners started talking more and more about AI. I asked them how to play it. They mentioned a company called Nvidia, which I thought was a gaming company I hadn't done work on in a long time.

I bought a pretty good chunk of it. And then like A month later, ChatGPT happened. It was just total luck. I had no idea chatgpt, but the AI drum around here was big enough and the stock was down, I think from 400 to 150 or something. So that's how I got started in it.

Once we invest in something like that, then we really start to dig deeper and then there was a whole chain of things. We knew it would affect power, we knew it would affect uranium. We just went through the whole chain and it was a pretty easy trend to spot. Not unlike the cloud was these things come in waves. But the question with AI now that I'm wrestling with and the reason our exposure is really neither long nor short is how to play it.

Because we started with picks and shovels, which is Nvidia and to some extent Microsoft, but now we're seeing just massive amounts of capital being spent by these modelers. And if AI is for real, and I think it is, they're all going to give you the same answer. So we're going to have four or five companies who have spent massive amounts of capital, but I don't see it as a winner take all model. On the other hand, I think there are applications that I haven't even thought of and nobody's thought of, they're going to spring up. I mean, who would have thought of Uber or Facebook when the Internet started?

So we're very bullish on AI, but we're not bullish currently on exactly where we're supposed to be and how to play it aggressively. Not unlike the Internet in 2000, 2001. You could have believed in the Internet, not been exposed and then got your exposure on a more timely basis. Or I could just be wrong, which wouldn't be that unusual.

I think I just gave a classic example. I didn't know that much about Nvidia. I just knew that AI and I had some people here tell me how to play it. So we bought Nvidia and then we, we were in the process of doing a lot more work and then ChatGPT happened. But I've always had the view that markets are smart, they're fast, and they're getting much more.

So with all the communication and the technology we have today. And that if I hear a concept and I like it, if I wait and spend two or three months analyzing it, I may miss a big part of the move and then psychologically be paralyzed. It's hard to buy a stock you're looking out of the 100, it's 160, even if it's going to 400. Somehow your head is screwed up and you're waiting for the pullback. So we will buy something, a meaningful position, but not earth shaking and then really do the work.

And if I think we made a mistake, I'll sell it. And if I don't think we made a mistake, we'll add to it if we have to.

Druckenmiller’s account underscores the psychological and strategic dilemmas of acting in markets defined by rapid shifts. His approach prioritizes opportunism over exhaustive diligence in the early stages. By taking a meaningful but measured position, he reserves the flexibility to double down or pivot as deeper analysis either validates or refutes the initial thesis. This adaptive strategy acknowledges the cognitive barrier of entering positions later at higher valuations, which can lead to paralysis and missed opportunities.

While Druckenmiller’s approach demonstrates the merits of acting decisively in rapidly evolving markets, it also reveals a critical distinction between public and private markets. Public investors retain the option to exit a position with relative ease, mitigating the risks associated with premature decisions. Venture capitalists, in contrast, face an inherently illiquid environment where commitment is long-term, and capital is effectively locked.

The Structural Divergence of Venture Capital

The illiquidity intrinsic to venture fundamentally differentiates it from public market strategies. Once a venture capitalist commits, there is no "selling out" of a position if the thesis unravels. The capital is effectively locked for the duration, amplifying the consequences of rushed decisions driven by speculative mania rather than substantiated insight. In this context, the "Invest First, Investigate Later" ethos entails risks that demand heightened scrutiny. The inability to hedge or unwind positions means that each decision carries amplified stakes, demanding both foresight and a willingness to endure prolonged uncertainty.

The current AI boom mirrors the archetypal trajectory of technological revolutions. Early exuberance inflates valuations and spawns an ecosystem of ventures, many of which lack the structural resilience to endure. The subsequent pruning phase inevitably exposes unsustainable business models, fierce competition, and the volatility of immature markets. For VCs, the challenge lies in discerning which companies possess the foundational strengths to thrive post-pruning, while resisting the allure of inflated, unproven opportunities.

This process requires not only rigorous due diligence but also a deep understanding of the technological and market dynamics at play. The value chain of AI, spanning infrastructure, models, and applications, is still nascent and fragmented.

Bottlenecks and Value Creation in AI

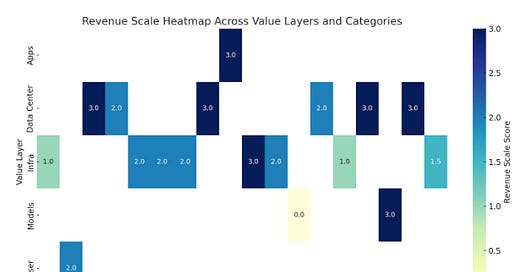

Understanding where value is created and where bottlenecks exist in the AI ecosystem is essential for navigating this transformative era. The following visuals illustrate these dynamics:

Visual 1: Revenue Scale Heatmap Across Value Layers and Categories

This heatmap highlights areas of significant revenue potential across the AI stack, from user-facing applications to core infrastructure. For example, data centers and managed infrastructure score highly on revenue potential due to their foundational roles. Conversely, some categories, like open-source tooling, exhibit lower revenue scales despite their critical importance in enabling broader adoption. This visualization underscores the uneven distribution of value and invites investors to focus on areas where returns are most scalable.

Visual 2: Business Durability Heatmap Across Value Layers and Categories

This second heatmap focuses on the robustness of business models across the AI ecosystem. While areas like proprietary hardware and power management demonstrate high durability due to barriers to entry, others, such as open-source and low-level infrastructure, face challenges in maintaining a competitive moat. By juxtaposing revenue potential with durability, this visualization helps identify categories that balance short-term opportunity with long-term sustainability.

By juxtaposing these two heatmaps, it’s easier to get a short-term outlook on AI’s viability. These visuals reveal that while some areas offer high revenue potential, they may lack durability—or vice versa—thus highlighting the challenge of the times when it comes to venture investing and putting into context valuations (and premiums).

Lessons from Historical Precedents

The parallels with the dot-com era are instructive. During the late 1990s and early 2000s, the internet's transformative potential was undeniable, but not every overhyped company survived to realize that potential. Investors who exercised restraint, waiting for the mania to subside, were able to identify enduring giants like Amazon and Google. Similarly, the AI revolution will catalyze paradigm-defining enterprises, yet history cautions against conflating early popularity with long-term viability.

Furthermore, technological revolutions often feature unexpected adjacencies and secondary markets that emerge over time. Just as the proliferation of the internet gave rise to industries such as e-commerce, social media, and cloud computing, the AI epoch may spawn entirely new sectors that are currently underappreciated (queue consensus view on agentic workflows).

A Pragmatic Slogan for 2024

I wonder if "Invest First, Investigate Later" should be the appropriate mantra for private market/venture investing in 2024. Unlike Druckenmiller’s model, venture capitalists lack the latitude to extricate themselves from missteps with minimal friction. I suspect we’ll see the spillover effect(s) in the years to come.

The challenge lies not in predicting the future with perfect accuracy but in building the frameworks and processes that allow for informed decision-making amidst ambiguity. With time, we’ll come to understand if I am truly the fool.