Welcome to issue #8 of Indiscrete Musings

I write about the world of Cloud Computing and Venture Capital and will most likely fall off the path from time to time. You can expect a bi-weekly to monthly update on specific sectors with Cloud Computing or uncuffed thoughts on the somewhat opaque world that is Venture Capital. I’ll be mostly wrong and sometimes right. Views my own.

Please feel free to subscribe, forward, and share. For more random musings, follow @MrRazzi17

This post is a bit aimless from the traditional Indiscrete postings but stemmed from something that’s been on my mind recently and further solidified after attending a conference where I got to meet and listen to Paraag Marathe, President of San Francisco 49ers Enterprises, speak. Paraag doesn’t need any further introduction, as he’s well-known for having transformed the 49ers organization into a burgeoning enterprise well beyond just football.

His background, relative to most of his peers, is highly atypical. Whereas most organizational NFL leaders come from either having played the game at a professional level or are deeply entrenched in the sport one way or the other, Paraag took an unconventional, non-linear path that goes against the traditional narrative and has contributed to his success. His story was uniquely compelling to me, considering our upbringings were similar. His family bought a local pizza joint in the Bay Area early on, and he grew up tending, caring for, and managing the pizza shop – the same way I managed my father’s Chucky E. Cheese growing up. Outside of our shared affinity for dough, marinara sauce, and toppings, Paraag, early in his career, was a consultant far before he was working for the 49ers. Through hard work, persistence, and a fresh eye considering his atypical background, he’s been able to achieve heights that no president/manager of an NFL team has achieved.

Proxies

Similar to Paraag’s unconventional career path to the 49ers, I’ve seen founders of all sorts of backgrounds, and often it’s hard to narrow in on the perfect background, but easy to default to a “proxy.” In venture, we often look for signals in founders that may indicate success, such as educational pedigree, the reputation of their prior companies (worked at or founded), historical success in scaling teams, or if they followed a traditional route into their career(s). We look for proxies because, intuitively and intellectually, labeling is more accessible than the duality in what can be.

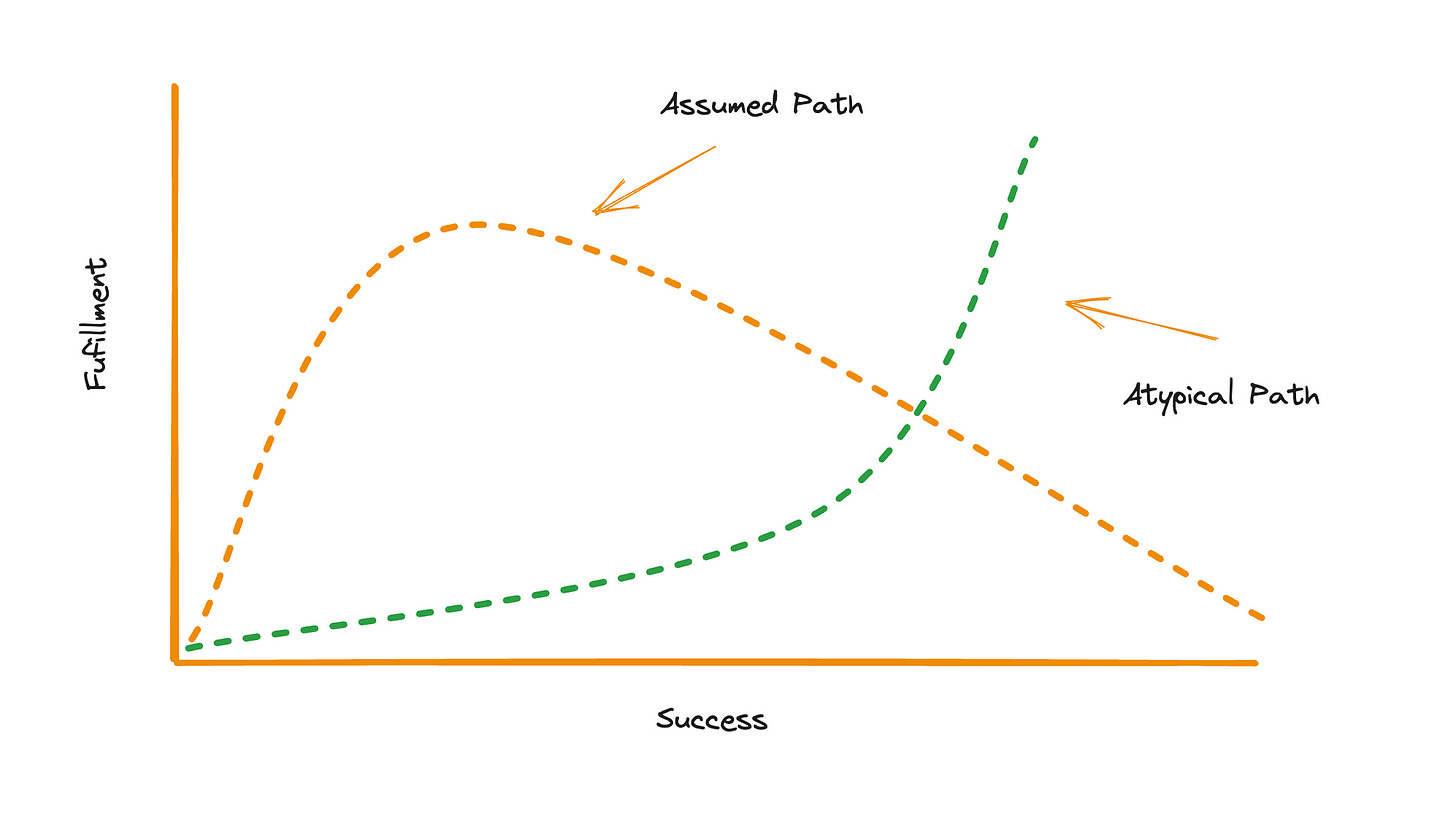

In other words, we seek proxies to justify our thinking and, as a result, solidify our perceived future results. I think this is even more acute at the earliest stages of investing (<Series A), where it becomes extremely hard to disentangle skill from luck. This is also pertinent to VCs writ large; by far, the most interesting and successful VCs (on a DPI basis) I know come from atypical backgrounds. This isn’t to assume you have to study humanities or epidemiology to generate returns because this discounts hard work, luck, and several other factors, but the point is there is a level of discounting we have to do in one’s past to find the collective consilient nature of their experiences. Of course, founder evaluation is only one part of the puzzle regarding diligence (e.g., identifying the right market tailwinds, competitive threats, and quantifying metrics). This post is about the lens through which VCs analyze the founder’s collective experience and often make assumptions.

Swans and the Unity of Knowledge

I will attempt to combine two concepts from two of my favorite books to emphasize the point further. First is The Black Swan by Nassim Taleb, and second is Consilience by E.O. Wilson.

(1) Black Swan

As defined by Taleb, a Black Swan is a highly improbable event that satisfies three criteria:

It is an outlier: The event lies outside the realm of regular expectations because it is rare and has an extreme impact.

It is unpredictable: Black Swan events are highly improbable and, by definition, difficult or impossible to forecast based on past data and historical patterns.

It is retrospectively explainable: After the event occurs, people often try to rationalize and create explanations for why it happened, even though it was not predicted or anticipated.

“Black Swan" is inspired by the historical belief that all swans were white because, for centuries, people in Europe had only observed white swans. However, when black swans were discovered in Australia, it shattered the assumption and demonstrated that seemingly impossible events could occur.

(2) Consilience

Consilience: The Unity of Knowledge is a book written by biologist Edward O. Wilson. The book's central theme is the concept of "consilience," which refers to the unity of knowledge across different disciplines. Wilson argues that all branches of knowledge, including the natural sciences, social sciences, and humanities, can be interconnected to form a coherent and comprehensive understanding of the world. He emphasizes the need for a holistic approach to knowledge, urging scientists, researchers, and thinkers to bridge the gaps between various disciplines. By integrating different branches of knowledge, consilience enables us to develop a deeper comprehension of complex phenomena and tackle pressing global issues more effectively.

Take the path never traveled

And so, how does this relate to the world of early-stage venture? I believe that we live in a world of randomness as defined by Taleb, and often, at the earliest stages, when there isn’t any data, we shouldn’t just rely on proxies and look for outliers by way of atypical backgrounds, as defined by Wilson. The knowledge can be multidisciplinary in nature or completely random.

Of course, this makes me skeptical of so-called “experts,” but in reality, often, their views are correct because they represent the consensus. While there isn’t anything wrong with the consensus per se, it’s worth noting the consensus is a snapshot of the current view, which doesn’t account for the future. For VCs, evaluating founders, it’s our job to imagine the world of what can be, the infinite number of improbabilities, the unpredictable, and through it all, move away from the traditional consensus view of safe-haven proxies. And for founders, do the thing(s) that interests you the most because there is no single path to success, and often outsized returns are the most random.

As always, If you think I’m wrong or missing crucial components to my thinking, please don’t hesitate to reach out so I can further stretch and refine my reflection! Feel free to drop me a note at zain [at] ridge.vc or a line on Twitter @MrRazzi17.