Agents + Agencies: Building Tomorrow's Moats

Leveraging Agency Acquisitions to Build a Competitive Edge in the Agentic Era

Welcome to issue #20 of Indiscrete Musings

I write about the world of Cloud Computing and Venture Capital and will most likely fall off the path from time to time. You can expect a bi-weekly to monthly update on specific sectors with Cloud Computing or uncuffed thoughts on the somewhat opaque world that is Venture Capital. I’ll be mostly wrong and sometimes right. Views my own.

Please feel free to subscribe, forward, and share. For more random musings, follow @MrRazzi17

I’ve been contemplating for some time what true advantage exists today for AI start-ups where the laws of scaling and pre-training are effectively ubiquitous. At the same time, while barring no sense of MOAT for early-stage start-ups (likely why there are now ten competitors on average at the seed!), there also lies the more significant issue at scale. For the first time in a while, it feels like the incumbents are dancing and moving at the speed of a 20-person start-up. Not only do they have the data and balance sheets to make this agentic era more accurate, but they also have existing large install bases, who, above the distribution, have known their customers for years on end. We’ve also seen not only impressive slopes of growth but also disastrous churn – coining the concept of experimental ARR. Net, things are moving fast, and they are becoming disorienting.

So, if one is truly to build an agentic platform, having more signals to train the models, SLMs, or LLMs seems innate, and this would benefit the incumbents. How are start-ups supposed to compete at the application layer for traditional B2B software? A lot of this thinking was evoked on the exceptional Bg2 Pod with Satya Nadella last week, and it's making its way through the echo chamber that is VC / X. There was some highly relevant commentary when it came Nadella’s point-of-view on transitioning from traditional software to the new era of agentic, excerpts below (starting at 46 min):

While I do believe in a world where using software moves from a 1:1 dependent model (e.g., user command) to a co-dependent (user only approves) agentic world, the above would make sense for incumbents like Microsoft or Salesforce per se. They’re best positioned to provide users (and buyers) with the most seamless agentic platform due to their sheer size, but indeed, their understanding of their customers through multiple years of understanding their respective nuance business context and building a product to match the need, enhancing product functionality for years on end, and more importantly, understanding when to enhance the workflow for their end customers via building or buying more products that fit the value chain of their customers.

So, how do start-ups compete in an era where incumbents building AI functionality or products have decades worth of data (e.g., signals) on how their customers have engaged in their products and how the users themselves have interacted with the products – closer to the agentic world we’re all so eager for.

Bear with me as I propose a not-so-radical shift happening in enterprise software. The notion of buying the B2B agency, whether that is a sales agency, marketing agency, medical billing agency, executive assistant agency, or traditionally an MSSP/MSP that has been serving, intimately, their customers for years. While, in theory, somewhat radical or perhaps history repeating itself, as it is somewhat known that Carta went about acquiring small firms that did 409a and cap table management to begin with it’s also slightly intuitive. Where else can you go that has built systems in place to capture serving end-customers for narrow markets (e.g., IT for VC/PE) where they intimately know the end-workflow for their customers, the tools they use, the actions they take, and the outputs they desire? It then would only intuitively make sense to be in the ring with one of the larger incumbents racing to build the agentic layer – that by unlocking vis-vie acquiring such firms/agencies, a start-up can have a significant head start in the race by leveraging the training data to most accurately depict actions that a user would take.

Aligned Incentives:

While the incentive for an AI start to roll up or acquire said agency for the ability to train on the data, the incentive for the agency also seems to be aligned — it’s no secret that such agencies face operational challenges such as rising labor costs, fragmented and outdated tooling, and generally scalability bottlenecks, coupled with the fact that many of these agencies tend to be SMB’s who are currently forgoing generational changes – see photo below from Rejigg – of an owner of an MSP that is roughly doing $1M a year in revenue is looking to sell the business due to the fact that he/she is approaching the age of retirement.

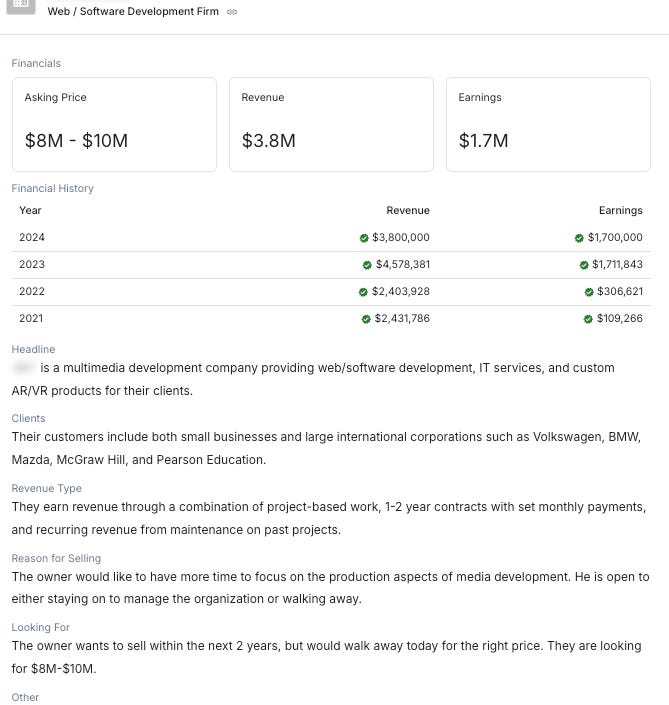

Here is another one of a web software and development firm that services large customers such as BMW and McGraw Hill, currently doing $3.8M in revenue and $1.7M in earnings.

Let’s assume that outside of some of the tech debt and organizational inefficiency that comes with any business, what is actually valuable for a start-up focused on building an agentic layer? I would posit that there are treasure troves of deeply embedded workflows, domain-specific expertise, and, as alluded to above, intimate customer data. It is also worth highlighting the consilient data that these agencies have. Many agencies/firms serve different clients, not just start-ups, and as a result`, provide persuasive and diverse data sets. Here are a few thoughts on why the strategy seems compelling:

Decades of Workflow Intelligence

Agencies have spent years refining their operations to serve specific customer niches. Whether a medical billing agency handles claim submissions or a sales agency nurtures leads, these workflows represent a living blueprint of user behavior. This data is invaluable for training AI systems to anticipate and augment user actions.Domain-Specific Customer Intimacy

Agencies understand the nuances of their customers' needs better than anyone else. Their tools, processes, and interactions reflect a wealth of knowledge about customer pain points and desired outcomes. Acquiring such firms means not only inheriting this data but also gaining a frontline view of what customers value most.Pre-Built Distribution Channels

Agencies have trusting customer bases. By layering AI capabilities on top of their established workflows, startups can introduce AI-enhanced solutions to a ready-made audience, reducing go-to-market friction and building credibility faster.Training Data as Competitive Moat

The primary battle in the agentic era is about contextual accuracy—creating AI systems that feel seamless because they know what the user is likely to do next. Agencies generate rich, real-time data about how workflows evolve, providing startups with a head start in training models that reflect real-world behaviors.Immediate Revenue Streams

Unlike traditional tech startups that spend years in R&D before scaling, acquiring agencies gives startups immediate revenue while they build their AI products. This creates a sustainable growth model while enabling the startup to iterate faster. It’s also worth highlighting that many start-ups (96%) never reach $1M in ARR1.

As for the relevant application sectors to approach, I’ve thought through many B2B sectors in which agencies/firms continue to thrive; while not exhaustive, here is a short list that comes to mind:

1. Managed Security Service Providers (MSSPs)

MSSPs are on the frontlines of cybersecurity, handling threat detection, vulnerability assessments, and incident response for clients across industries. By acquiring an MSSP, AI startups gain access to a wealth of cybersecurity data, workflows, and client needs, enabling them to build predictive AI systems for proactive threat hunting and streamlined incident management. The sheer size of the market alone makes this the most compelling, $65B market size, with a 17.6% CAGR2.

2. Virtual Staffing Agencies:

Virtual staffing firms specialize in providing businesses with remote executive assistants, customer service representatives, and administrative staff. These agencies manage tasks such as scheduling, email triage, data entry, and CRM updates.

AI Opportunity: Train AI copilots to assist virtual staff, automate routine tasks, and improve efficiency for end clients. Acquiring such agencies provides rich insights into how clients utilize remote assistance, enabling startups to develop agentic systems that act as “super assistants” for businesses.

3. ERP Implementation and Support Agencies

ERP agencies help businesses integrate, customize, and maintain enterprise resource planning systems. They manage workflows such as data migration, module setup, and process optimization.

AI Opportunity: Agency data can be used to train AI models that automate ERP implementation, predict system bottlenecks, and provide continuous optimization recommendations. Startups can leverage this to build AI-native ERP solutions that deliver greater flexibility and scalability.

4. Marketing Agencies:

Marketing agencies handle campaign planning, execution, and optimization for clients. Their workflows include audience segmentation, A/B testing, and performance reporting.

AI Opportunity: Acquiring a marketing agency gives startups immediate access to campaign performance data, enabling the development of AI systems that automate ad creation, optimize spend, and generate actionable insights for clients.

5. Sales Enablement Agencies (e.g., Landbase)

These agencies assist businesses with lead generation, prospect outreach, and sales pipeline management. They also manage data-heavy workflows involving CRM updates, follow-ups, and customer profiling.

AI Opportunity: Train AI models to prioritize leads, craft personalized outreach, and suggest next-best actions for sales teams. By layering AI on top of an existing sales agency, startups can create predictive sales enablement tools that improve conversion rates.

6. Medical Billing Agencies:

Medical billing agencies process insurance claims, manage revenue cycles, and ensure compliance with healthcare regulations. They operate at the intersection of administrative complexity and financial performance.

AI Opportunity: Build AI tools that automate claim submissions, detect errors, and predict denials. Acquiring a medical billing agency provides access to workflows that can inform AI solutions for revenue optimization and compliance.

7. Accounting Services Agencies:

Accounting firms for B2B clients manage bookkeeping, financial reporting, and compliance for businesses. They handle repetitive, time-sensitive tasks with high stakes for accuracy.

AI Opportunity: Train AI systems to automate bookkeeping, generate real-time financial insights, and flag potential compliance issues. Acquiring an accounting agency allows startups to develop AI-driven finance platforms tailored to the needs of small and midsize businesses.

8. Call Center Agencies:

Call centers manage customer inquiries, issue resolution, and post-sales support for businesses. They deal with massive data volumes and high agent turnover.

AI Opportunity: Develop AI-powered virtual agents, real-time sentiment analysis tools, and intelligent call routing systems. Acquiring a call center agency provides direct access to client needs and communication workflows, enabling startups to build more competent customer service platforms.

The Hypothetical Playbook:

Thinking through this, and after a few conversations with founders considering tackling some of the markets above, here is the hypothetical playbook that one can leverage to operationalize this strategy and leverage it effectively. Yes, I understand that what is outlined sounds very PE-like. To me, that is necessary if one is to pursue this path to potentially unlock the agentic era or get many steps ahead of the competition in an attempt to do so:

Step 1: Acquire the Agency

The initial step is acquiring a small-to-midsize agency within a sector aligned with your AI’s core competencies. The ideal targets for acquisition include:

Revenue under $3 million: These agencies are large enough to provide significant workflow data and customer insights but remain affordable for early-stage startups.

EBITDA margins below 17%: While operationally functional, these agencies are often less attractive to traditional PE firms due to their lower profitability.

Small teams: Typically fewer than 15 full-time employees, making integration more manageable.

The acquisition cost for agencies within this range aligns well with startups that have raised $5M to $7 million in equity financing (venture), leaving room for post-acquisition investments in AI tools, integration, and scaling.

Step 2: Enhance with AI

Once acquired, the next step is layering AI and automation on top of the agency’s workflows. This creates immediate value through improved efficiency, cost reductions, and enhanced service offerings. Key initiatives include:

Automating repetitive tasks (e.g., data entry, report generation, or campaign execution).

Improving decision-making through AI-powered insights, such as predictive lead scoring or anomaly detection.

Enhancing customer value by offering AI-driven tools that enable clients to scale faster and achieve better outcomes.

Step 3: Leverage Data for Model Training

The acquired agency provides a treasure trove of workflow data and customer insights, which can be used to train and refine AI models. This data allows startups to create systems that are more contextually accurate and better aligned with real-world user needs than competitors starting from scratch. Over time, this creates a proprietary competitive moat.

Step 4: Build a Scalable Platform

By refining workflows and integrating AI, startups can transition the agency’s services into a unified, AI-enhanced platform. This platform should:

Consolidate workflows and tools into a seamless, data-driven system.

Offer additional revenue streams, such as AI-powered upsells or subscription services.

Position the startup for scalable growth in adjacent verticals or markets.

Step 5: Expand Through Acquisitions or sell the agentic platform

With the initial acquisition successfully integrated, a startup can replicate this playbook by acquiring additional agencies. Focus on complementary sectors or geographic markets to build a diversified, scalable AI-enabled portfolio. Each new acquisition increases revenue and enriches the data available for AI training. Or, leverage the agentic platform to sell as the ‘data layer’ for your respective vertical.

Illustrative Economics and Investment Case

This model is particularly well-suited for startups with $5 million - $7 million in venture funding and a focus on achieving high scalability through thoughtful investments. The economics of this model are as follows:

Initial Agency Economics:

Revenue: <$3 million.

EBITDA: $400K-$600K (below typical PE thresholds of $2M-$6M EBITDA).

Acquisition multiples: 4-5x EBITDA, translating to ~$1.6M-$3M per acquisition.

Lines of credit/ARR revolvers could also fund multiple acquisitions, many SMBs with positive EBIDTA tend to have line(s) of credit

Debt-Financed Structure: Post-initial acquisition, additional acquisitions can be financed through debt, leveraging 4-5x EBITDA multiples. This reduces the need for further equity raises and allows founders and early investors to retain more ownership while scaling the platform.

Customer Profile:

Minimal customer concentration

Preferred multi-year contracts

Margin Goals:

Targeting 70%-75% gross margins across the combined business.

ARR and Scalability:

MSPs and agencies often operate with 80% recurring revenue and a predictable CAC

Great, but why venture?

While this strategy involves M&A, it is better aligned with VC dynamics for several reasons:

Initial Investment Requirements: The model requires upfront investment in integrating AI tools and software development to modernize the acquired agency. The acquired business and software components still need to be profitable and will need time to mature, making them less attractive to PE firms seeking immediate cash flow.

Lower EBITDA Margins: Traditional PE targets MSPs and agencies with $2M-$6M in EBITDA and established profitability. In contrast, this model focuses on agencies with $400K-$600K EBITDA, offering a higher potential for value creation but requiring operational improvements to realize it.

Reduced Need for Follow-On Equity Rounds: After the initial funding, the use of debt financing to acquire additional agencies minimizes dilution for founders and early-stage investors. This allows startups to scale with smaller capital contributions compared to traditional VC-backed models, ultimately improving ownership retention, notwithstanding the ability to leverage the learnings to build a true agentic platform.

Strong Value Creation Potential: By achieving 70% to 75% gross margins and leveraging AI to streamline operations, the combined business can outperform traditional VC investments in terms of growth potential and enterprise valuation.

Agencies in this range often trade at 4-5x EBITDA, but AI-driven operational improvements can significantly enhance margins and justify higher revenue multiples.

Scalability and Market Opportunity: The model targets overlooked agencies in fragmented markets, creating opportunities for consolidation and scalable growth. With predictable CAC and high recurring revenue, the platform has a strong trajectory for value creation—and the ability to compete against larger software giants building agentic layers in-house.

Human Work Automation is Now Possible with AI Agents:

Recent advances in AI have made it possible to automate a wide range of human workflows, particularly in service-heavy industries. Agencies serve as data-rich training grounds for building AI agents capable of replacing or augmenting repetitive human tasks. This opportunity is particularly compelling for VC, which prioritizes scalable, tech-enabled growth.The Suppressed M&A Market Creates Opportunity:

High interest rates have suppressed the M&A market over the last few years, creating a backlog of agencies seeking exits. Many small-to-midsize agency owners are motivated sellers, making acquisition opportunities more attractive and affordable for startups with limited capital.Demographics Are Driving Exits:

A significant number of agency owners belong to the baby boomer generation, many of whom are approaching retirement. This demographic trend is creating a wave of agencies looking for buyers. These businesses are often operationally sound but have not fully embraced technology or automation, presenting a prime opportunity for VC-backed startups to modernize and scale.

For AI startups, acquiring domain-specific agencies represents a transformative strategy for AI startups to counter incumbent advantages. By leveraging entrenched workflows, customer expertise, and pre-established trust, startups can build AI systems that deliver unparalleled contextual accuracy and scalability.

This approach not only accelerates time-to-market but also constructs a defensible competitive moat rooted in proprietary data and operational intelligence. In the agentic era, this framework provides a compelling blueprint for emerging ventures to thrive amidst formidable competition. If we view the world of start-ups from the lens of scientific thinking, perhaps this one hypothesis needs further validation and tinkering. I’m eager to see how this hypothesis plays out, as several start-ups are attempting to go about this path. If you’re building or generally think that my rationale may be flawed, please reach out.

Big thank you to Abhishek Dubey for the thoughtful and insightful edits.

https://venturebeat.com/entrepreneur/getting-to-50-million-how-to-avoid-the-saas-valley-of-death/

Gartner