Unprecedented Consumer Activity leading to Global CDN Consumption

CDNs are estimated to carry 72% of all Internet traffic by 2022

Welcome to issue #2 of Indiscrete Musings

I write about the world of Cloud Computing and Venture Capital and will most likely fall off the path from time to time. You can expect a bi-weekly to monthly update on specific sectors with Cloud Computing or uncuffed thoughts on the somewhat opaque world that is Venture Capital. I’ll be mostly wrong and sometimes right.

Please feel free to subscribe, forward, and share. For more random musings, follow @MrRazzi17

First, a primer: Content Delivery Network (CDNs)

A content delivery network (CDN) is a highly distributed platform of servers that help reduce latency in loading web page content by reducing the physical distance between the server and the user. Without a CDN, origin servers must respond to every single end-user request which results in overloading the origin, thereby increasing the chances of origin failure and cumbersome (and unpredictable) infrastructure costs. CDNs allow for the quick transfer of static and dynamic assets. Examples of static assets are HTML pages, javascript files, stylesheets, and images. Examples of dynamic assets are videos both recorded and live. The benefits of using a CDN are numerous ranging from improving website load times across desktop, tablet, and mobile, reducing bandwidth costs, increasing the availability of content and redundancy, and improving overall website security (protection against volumetric DDoS attacks).

In the ever-present online world that we live in, in which every part of our lives has been upended by accessing the internet, uptime is a critical component for anyone and anybody with internet property.

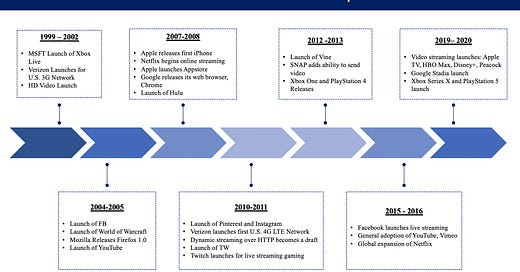

CDN Catalysts over the Years

The quantity of content on the Internet has exploded over the last decade. The illustration above displays a brief history of technology-driven catalysts throughout the years leading to the overall usage and consumption of CDNs. Key drivers of Internet traffic growth have included several historical events such as Apple’s iPhone launch, the progression of 3G to 5G, the launch of various consumer-oriented platforms such as YouTube, various online multiplayer videogames, the continual growth of e-commerce, cloud computing, and the exponential rise of social media platforms. Estimates from Cisco indicate these levels of consumption aren’t slowing down in the near future, Cisco predicts that more IP traffic will flow across the Internet from 2017 - 2022 than in the whole history of the Internet1. Cisco’s Visual Networking Index (VNI) forecasts projects global IP traffic to grow at a CAGR of 26% from 2017 to 2022, driven by mobile data growing the fastest at a CAGR of 46% and fixed Internet growing at 26%.

Since 2015, the CDN industry has suffered from competition, commoditization, and the lack of technology-driven catalysts that would require fast, reliable, and scalable services as demonstrated by the historic technology events of the last two decades. CDN Prices (usually contingent upon bandwidth throughput and geography distribution) has been steadily declining by ~20% per year for the last decade, as such, revenue growth for CDNs involves volumetric growth which helps offset the current declines. Interestingly, CDN revenue continues to increase which is indicative of the explosion in the volume of traffic that is occurring over the Internet. While this level of pricing commoditization has transpired for the last ~6 years, CDN demand does frequently fluctuate contingent upon global consumer demand (i.e. volume). More recently there seem to be two large volume drivers which should strengthen the shift of CDN spend going forward into the decade, both drivers are analogous to the technology-based catalysts of the last ~20 years, the saturation of video streaming services, and the growth of online gaming, both of which have yet to be fully realized but the initial traction seems promising.

IDC estimates that online gaming is growing equally as fast as video streaming, at a CAGR of 21.6% through 20242. CDN vendors are directly positioned to benefit from growth in online gaming, as they provide faster execution of content and are increasingly necessary for executing cloud-based multiplayer games with nominal latency. By utilizing a distributed network of servers that brings content closer and more accessible to the eye-ball (e.g., consumers), CDNs are capable of delivering synchronous gaming content across multiple geographies, in all most real-time.

CDNs are estimated to carry 72% of all Internet traffic by 2022

In addition to video streaming and online gaming, global IP traffic is anticipated to reach 396 exabytes per month by 2022, tripling from 122 exabytes per month in 2017. This estimate equates to 4.8 zettabytes of traffic per year by 2022. CDNs are well-positioned to be one of the primary distribution channels to support this traffic. According to Cisco, CDNs are estimated to carry 72% of all Internet traffic by 2022. With differentiated consumer revenue streams like video streaming, online gaming, and existing growing trends such as global e-commerce, it’s likely that CDNs will continue to be a key tenant of the Internet.

CDN Providers

There are a handful of CDN providers in the industry today – larger incumbents such as Akamai, AWS CloudFront, Cloudflare, Fastly, Google CDN, Azure CDN – and entrants such NetDNA, BelugaCDN, KeyCDN, PageCDN to name a few. For a fully comprehensive list of providers, recommend looking through CDNPerf.

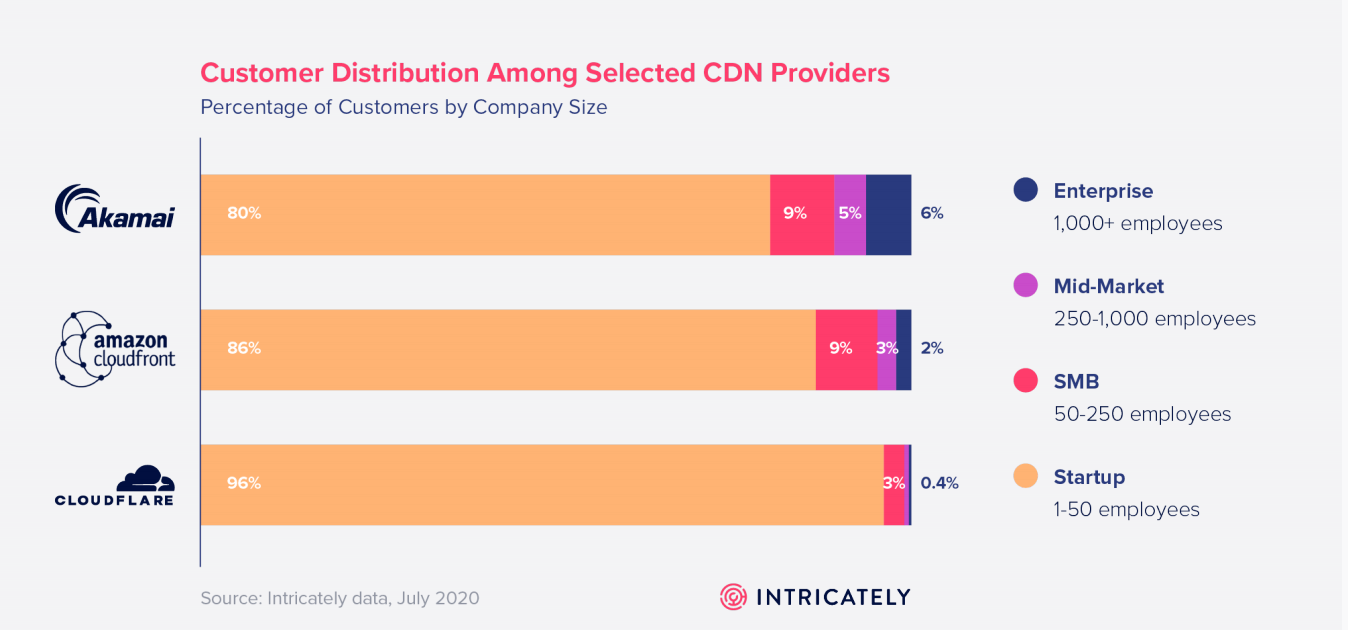

Most vendors will often choose a CDN provider dependent on their use case, whether it be to serve a large install base in Europe and needing a provider with a heavy presence within the geography, or choosing a local provider serving a subset of geographically constrained users. It’s not uncommon for large enterprises to use more than one provider, what’s known as a multi-CDN strategy where enterprises will use multiple CDNs to load-balance traffic and increase overall redundancy in the case of an outage. According to the most recent Intricately CDN report, the top CDN providers by revenue are Cloudflare, AWS CloudFront, Akamai. Across these three providers, they control more than half of the market.

Akamai, given its first-mover advantage in the space, has a significant grip within the enterprise though has a smaller overall total number of customers as compared to Cloudflare and AWS CloudFront. With the proliferation of content on the Internet, I suspect larger players will continue to hold their grip given their reach. I’ll dive deeper into the differences between each provider in a later post and specific use case(s) each solve.

Conclusion

The global growth of video streaming services (e.g., Netflix, Hulu, HBOMax), online gaming (e.g., Stadia, Microsoft xCloud) will favor CDN usage in the long term. In addition to content, many consumers are coming online for the very first time in places such as India, with the continued efforts around low data plans in emerging markets and the proliferation of content, CDNs are positioned well to capture this momentum. As a result, CDN’s will continue to serve as an invisible abstraction layer to ensure that consumers can continue to enjoy the modern wonders of the Internet (in a timely manner).

Cisco Annual Internet Report - Cisco Annual Internet Report (2018–2023) White Paper

IDC: Worldwide Content Delivery Network Forecast, 2020–2024